Our portfolio is composed of retail properties on the outskirts of urban areas in Belgium, France and Spain, characterised by a predominance of the food sector.

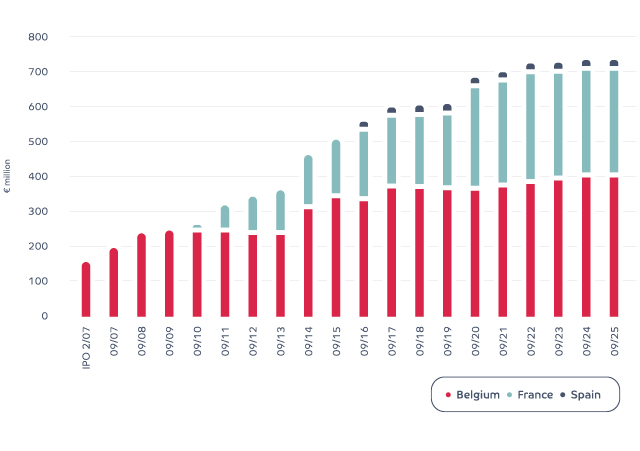

Portfolio growth

| Consolidated results (€000s) | 30/09/2025 | 30/09/2024 |

|---|---|---|

| Rental income | 53,866 | 53,345 |

| Rental related charges | -95 | -223 |

| Recovery of property charges | 1,116 | 766 |

| Rental related charges and taxes not recovered | -219 | -308 |

| Other revenue and rental related charges | -118 | -15 |

| Property Result | 54,552 | 53,565 |

| Property charges | -5,562 | -5,074 |

| Corporate overheads | -4,907 | -4,958 |

| Operating result before result on portfolio | 44,086 | 43,534 |

| Operating margin | 81.8% | 81.6% |

| Financial income | 461 | 309 |

| Net interest charges | -5,895 | -6,477 |

| Other financial charges | -952 | -816 |

| Taxes | -565 | -364 |

| EPRA Earnings | 36,678 | 36,185 |

| Result on sales of investment properties | 1,061 | 1 |

| Change in the fair value of investment properties | 77 | 5,963 |

| Change in fair value of financial assets and liabilities | -2,408 | -16,395 |

| Deffered tax | -228 | -238 |

| NET RESULT | 35,637 | 25,517 |

| EPRA Earnings per share (€) | 5.56 | 5.49 |

| Net result per share (€) | 5.40 | 3.87 |

| Number of shares | 6,595,985 | 6,595,985 |

| Consolidated balance sheet (€000s) | 30/09/2024 | 30/09/2023 |

|---|---|---|

| Assets | 780,658 | 786,469 |

| Intangible assets | 375 | 236 |

| Investment properties | 748,621 | 740,856 |

| Other tangible assets | 963 | 49 |

| Other non-current assets | 16,145 | 30,670 |

| Assets held for sale | 259 | 0 |

| Current financial assets | 926 | 867 |

| Trade receivables | 6,120 | 5,556 |

| Cash and cash equivalents | 3,070 | 5,423 |

| Other current assets | 4,179 | 2,811 |

| Equity and liabilities | 780,658 | 786,469 |

| Equity | 442,921 | 444,763 |

| Non-current financial debts | 196,391 | 262,670 |

| Other non-current liabilities | 5,060 | 2,806 |

| Deferred taxes liabilities | 6,516 | 6,085 |

| Current financial debts | 115,280 | 57,829 |

| Other current liabilities | 14,491 | 12,316 |

| IFRS NAV (€/share) | 67.15 | 67.43 |

| EPRA NTA (€/share) | 65.80 | 63.59 |

| Debt ratio (in accordance with the Royal Decree) | 42.8% | 44.0% |

| EPRA LTV | 42.1% | 43.4% |

| Consolidated result per share (EUROS) | 30/09/2024 | 30/09/2023 |

|---|---|---|

| EPRA earnings | 5.49 | 5.46 |

| Net result per share | 3.87 | 5.13 |